Photovoltaics Market Size, Share, Trends and Growth

Photovoltaics Market by Material (Silicon, CIGS, CdTe, Perovskite, Organic Photovoltaic, Quantum Dot), Component (Modules, Inverters, BOS), Installation Type (Ground-mounted, Building-integrated, Floating), Cell Type and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The photovoltaics market is projected to reach USD 968.32 billion by 2030 from USD 613.57 billion in 2025, at a CAGR of 9.6% from 2025 to 2030. The increasing level of solar installations worldwide is heavily influenced by government-supported incentives and policy structures that push the implementation of renewable energy. Subsidies, tax credits, feed-in tariffs, and net metering schemes have greatly enhanced the cost and ROI for photovoltaic (PV) systems for residential, commercial, and utility-scale applications.

KEY TAKEAWAYS

-

BY COMPONENTModules is expected witness highest CAGR in the photovoltaic market as they form the core component responsible for converting sunlight into electricity. Their increasing deployment in large-scale solar farms and rooftop systems, along with continuous improvements in efficiency and cost reduction, is driving their dominant position in the market.

-

BY TYPEThe rigid type of segment is expected to hold a larger market share in the photovoltaics market due to its widespread use in residential, commercial, and utility-scale installations. These panel types can achieve higher efficiency rates, require less maintenance, and can operate longer than flexible alternatives.

-

BY MATERIAL TYPESilicon will dominate the photovoltaics market due to its widespread acceptance, proven performance, and cost-effectiveness. Silicon, whether in monocrystalline or polycrystalline wafers, remains the primary material for solar cell production because of its high energy conversion efficiency, long lifespan, and plentiful availability.

-

BY CELL TYPEHalf-cell PV modules are expected to hold the largest market share due to their higher efficiency, lower resistive losses, and improved shade tolerance compared to traditional full-cell modules. Their enhanced power output and durability make them ideal for both residential and utility-scale solar installations, driving widespread adoption across the photovoltaic market.

-

BY INSTALLATION TYPEBased on installation type, the floating PV segment is expected to witness a higher CAGR during the forecast period. The floating photovoltaic (PV) segment is expected to register a higher CAGR during the forecast period due to its ability to overcome land constraints and utilize underused water bodies such as reservoirs, lakes, and canals. This installation type offers a dual advantage, generating clean energy while reducing water evaporation and algae growth.

-

BY APPLICATIONThe utilities segment is projected to capture the largest share of the photovoltaics market in 2030, driven by large-scale solar farm deployments. Rising energy demand, supportive government policies, and declining solar installation costs encourage utility companies to invest heavily in photovoltaic infrastructure.

-

BY REGIONThe photovoltaic market covers Europe, North America, Asia Pacific, and the RoW. The Asia Pacific is expected to hold the largest market share in 2030. This market is driven by robust solar deployment policies, growing energy demand, and strong manufacturing capabilities. Countries such as China, India, Japan, South Korea, and Australia are at the forefront of solar adoption, with China alone accounting for a significant portion of global PV module production and installations.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Jinko Solar (China), JA SOLAR Technology (China), and Trinasolar (China) have entered into agreements and partnerships to cater to the growing demand for aerospace materials in innovative applications.

The photovoltaics market is witnessing steady growth, driven by the growing global emphasis on clean and sustainable energy sources. Governments and industry are moving towards renewable energy to reduce carbon emissions and fulfill climate targets. Supportive guidelines, tax enforcement, and renewable energy goals encourage mass solar adoption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the photovoltaics market, factors such as growth in the adoption of PV systems for residential applications, decreasing costs of PV systems, and advancements in energy storage devices are driving overall market expansion. The integration of emerging technologies, such as half-cell, PERC, and bifacial cell technology, is expected to enhance system output levels, improve PV module efficiency, and increase durability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising government incentives and schemes to encourage solar energy adoption

-

Decreasing cost of energy storage devices

Level

-

Shortage of skilled workforce for PV installation

-

Safety risks associated with high DC voltages

Level

-

Increasing investment in renewable energy to address climate change

-

Rapid advances in Perovskite PV technology

Level

-

Legal issues related to land allotment for solar deployment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Decreasing cost of energy storage devices

The steady decrease in the price of PV systems and energy storage units has been a key growth driver for the global photovoltaic market. Improvements in solar panel manufacturing, enhanced module efficiencies, and scale economies have reduced the levelized cost of electricity (LCOE) from solar sources sharply in the last decade. At the same time, advancements in materials such as passivated emitter rear cells (PERC), bifacial modules, and thin-film technologies have enhanced performance while reducing the production cost.

Restraint: Shortage of skilled workforce for PV installation

The lack of a skilled workforce for PV system installation and maintenance presents a significant restraint to the growth of the photovoltaics market. As global demand for solar energy rises, the need for qualified technicians, engineers, and maintenance professionals has grown rapidly. However, many regions, particularly in developing economies, face a shortage of trained personnel equipped with the technical knowledge required to handle complex PV system installations, electrical integration, and post-installation servicing.

Opportunity: Rapid advances in Perovskite PV technology

Continued technological innovation, especially in the evolution of Perovskite solar cells, offers a major opportunity for the photovoltaics market. Perovskite materials have shown great promise in increasing solar cell efficiency, flexibility, and affordability. Perovskite cells, unlike conventional silicon-based PV cells, can be manufactured with simpler processes and cheaper materials, potentially reducing overall production costs. Their flexibility with flexible substrates also presents new opportunities in lightweight, portable, and building-integrated photovoltaics (BIPV), which further broaden the application field of solar applications in many industries.

Challenge: Legal issues related to land allotment for solar deployment

Land procurement continues to be a major hurdle in the development of large-scale solar PV projects, especially in highly populated or agricultural areas. Large solar farms need huge expanses of flat, open land with high solar irradiation. Procuring such land typically entails intricate regulatory permits, protracted negotiations involving multiple parties, and land ownership, usage rights, and environmental regulatory challenges.

Photovoltaics (PV) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of high-efficiency Tiger Neo N-type bifacial modules in utility-scale solar farms and commercial rooftops | Enhances energy yield with higher conversion efficiency and improved performance under low-light conditions |

|

Supply of PERC and bifacial modules for industrial and commercial solar power plants across Europe and Asia | Provides stable power generation and reduces the overall levelized cost of electricity (LCOE) | Provides stable power generation and reduces overall levelized cost of electricity (LCOE) |

|

Implementation of Vertex series ultra-high-power modules in large commercial installations and smart energy projects | Delivers greater energy density, space optimization, and long-term reliability |

|

Integration of monocrystalline P-type and HJT modules in corporate and industrial solar projects | Offers superior efficiency, longer lifespan, and consistent performance in diverse climates |

|

Production and deployment of high-efficiency solar cells and modules for distributed commercial energy systems | Ensures cost-effective energy production with high conversion rates and sustainability benefits |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The photovoltaics ecosystem comprises diverse stakeholders, including raw material providers, component manufacturers, distributors, and end users. Each segment is crucial in driving innovation, manufacturing efficiency, and the widespread adoption of solar technologies. Raw material suppliers provide critical inputs such as high-purity silicon but face challenges related to pricing volatility and global supply chain risks. Component manufacturers focus on producing high-efficiency modules, inverters, and electronics, often collaborating with firms and power producers to accelerate deployment. Distributors ensure reliable market access, logistics support, and technical services for downstream partners. End users range from residential consumers to corporates, reflecting diverse demand patterns.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Photovoltaics Market, By Component

As of 2024, the Balance of system (BOS) segment held the largest market share during the during the forecast period, The Balance of System (BOS) segment is expected to hold the largest market share in the photovoltaics market during the forecast period due to its high collective cost as compared to other components and its critical role in supporting the overall solar power infrastructure. BOS includes all components of a PV system, excluding the solar panels, such as inverters, mounting structures, wiring, switches, junction boxes, monitoring systems, and energy storage. As solar installations grow in size and complexity, the demand for advanced BOS solutions increases to ensure optimal performance, safety, and efficiency.

Photovoltaics Market, By Type

The rigid type is expected to hold a larger market share in the photovoltaics market due to its widespread use in residential, commercial, and utility-scale installations. These panel types can achieve higher efficiency rates, require less maintenance, and can operate longer than flexible alternatives. Rigid panels are established in the manufacturing sectors and tend to have comparable prices with their alternatives. Rigid panels are compatible with fixed installations where minimal structural limitations exist. As demand increases for large-scale solar projects, their utility in a solar project will not diminish.

Photovoltaics Market, By Material Type

The exterior segment is expected to dominate the aerospace materials market, as aircraft structures require lightweight yet durable materials to ensure strength, aerodynamics, and fuel efficiency under extreme conditions. Advanced composites, like CFRPs, are used extensively in the Airbus A350 and Boeing 787, and deliver up to 20% fuel savings while enhancing durability. Aluminum alloys such as 7075 and Al-Li remain critical for fuselage skins and wing ribs due to their toughness, repairability, and cost-effectiveness in large-scale production.

Photovoltaics Market, By Cell Type

Silicon segment to hold largest share of photovoltaics market in 2030, Driven by its wide acceptance with proven performance and cost-effectiveness, silicon, in the form of monocrystalline or polycrystalline wafers, continues to be the dominant material used in solar cell manufacturing owing to its high energy conversion efficiency, long service life, and abundance. Additionally, the mature production ecosystem and the well-established supply chain for silicon-based components make the large-scale deployment and scaling of PV systems in residential, commercial, and utility applications possible. Advances in silicon-based photovoltaic technology, including passivated emitter rear cell (PERC) and bifacial modules, have similarly enhanced solar panel efficiency and power output, making them increasingly appealing to investors and developers

Photovoltaics Market, By Installation Type

The floating PV segment is expected to witness a higher CAGR during the forecast period. The floating photovoltaic (PV) segment is expected to register a higher CAGR during the forecast period due to its ability to overcome land constraints and utilize underused water bodies such as reservoirs, lakes, and canals. This installation type offers a dual advantage, generating clean energy while reducing water evaporation and algae growth. Countries facing land scarcity and high population density, such as Japan, South Korea, and parts of Europe, are increasingly investing in floating PV solutions

Photovoltaics Market, By Application

The residential segment will record the highest CAGR in the photovoltaics market between 2025 and 2030. The residential segment is majorly driven by the increasing awareness among consumers about the benefits of solar energy, such as reduced electricity bills, long-term cost benefits, and energy independence. The increased acceptance of rooftop solar in urban and semi-urban regions, bolstered by government incentives, such as net metering policies, tax rebates, and subsidy programs, has further accelerated commercialization. Technological progress has improved panel designs, rendering compact and aesthetically integrated PV systems attractive to homeowners.

REGION

Asia Pacific to be fastest-growing region in global photovoltaics market during forecast period

The Asia Pacific is expected to hold the largest photovoltaics industry share in 2030, driven by robust solar deployment policies, growing energy demand, and strong manufacturing capabilities. Countries such as China, India, Japan, South Korea, and Australia are at the forefront of solar adoption, with China alone accounting for a significant portion of global PV module production and installations. The region benefits from high solar irradiance, large-scale land availability, and favorable policy frameworks, including feed-in tariffs, capital subsidies, and renewable energy targets supporting utility-scale and rooftop solar projects.

Photovoltaics (PV) Market: COMPANY EVALUATION MATRIX

In the photovoltaics companies matrix, Jinko Solar (China) leads with a strong market share and extensive product footprint. Star companies provide mature and reputable products and services. They meet the requirements of most applications, industries, and regions worldwide. GCL-SI.(China) (Emerging Leader) is gaining visibility with its enhanced portfolio of photovoltaic products.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 613.57 Billion |

| Market Forecast in 2030 (Value) | USD 968.32 Billion |

| Growth Rate | CAGR of 9.6% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Gigawatt) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: Photovoltaics (PV) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solar Project Developer |

|

|

RECENT DEVELOPMENTS

- January 2025 : JA Solar has signed a 1.25 GW module procurement agreement with China Energy Engineering Corporation (CEEC). The agreement secures JA Solar as the exclusive supplier of high-efficiency n-type photovoltaic (PV) modules for the Abydos Phase II 1GW+600MWh PV-Storage Project, developed by AMEA Power and constructed by CEEC.

- December 2024 : LONGi unveiled its next-generation solar modules, the Hi-MO X10 and Hi-MO 9, at an event in Ho Chi Minh City. Hi-MO X10 includes advanced HPBC 2.0 technology and TaiRay silicon wafers. It resolves shading and hot spots with the soft breakdown design. It integrates HPBC 2.0 technology for efficiency and reliability, with a power output of up to 670 W and a conversion efficiency of 24.8%.

- February 2024 : Jinko Solar unveiled its First Neo Green Panels produced with Renewable Energy. These N-type TOPCon Tiger Neo panels are produced in factories that were awarded the “Zero Carbon Factory” certification by TÜV Rheinland for their compliance with the criteria and requirements of such certification.

Table of Contents

Methodology

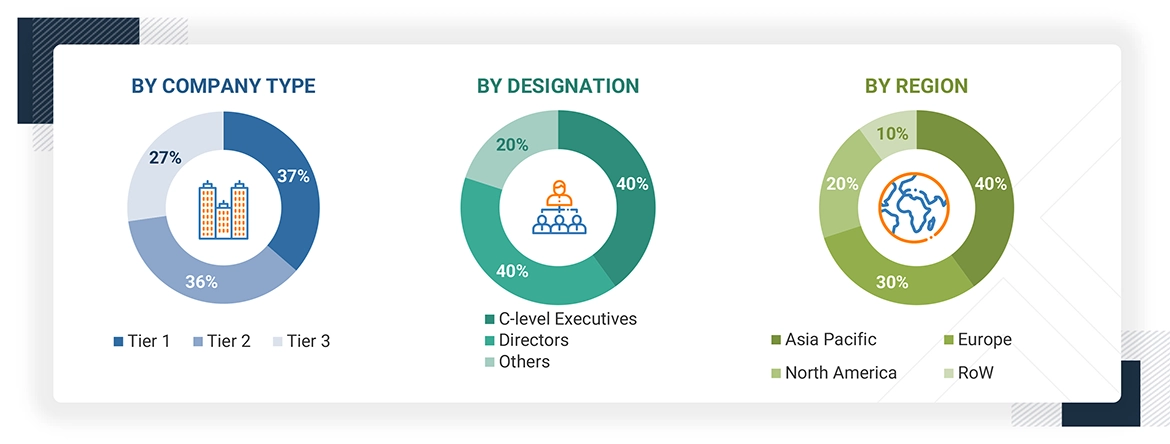

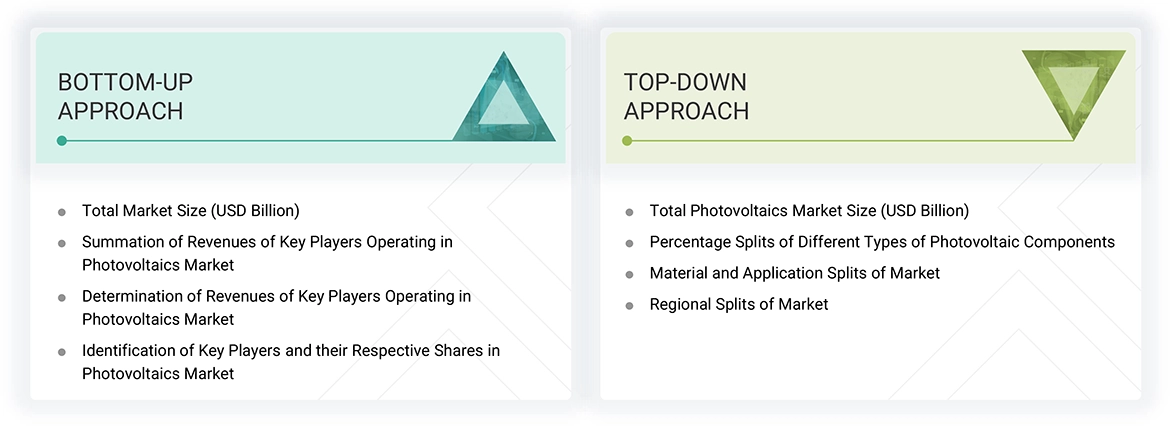

The study involved major activities in estimating the current size of the photovoltaics market. Exhaustive secondary research was done to collect information on photovoltaics. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the photovoltaics.

Secondary Research

Secondary sources for this research study include government sources, corporate filings (annual reports, investor presentations, and financial statements), trade journals, articles, white papers, industry news, and business and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research. A few important secondary sources referred to for this research study are the Solar Energy Industries Association (SEIA), the American Solar Energy Society (ASES), the International Electrotechnical Commission (IEC), and the Indian Solar Manufacturers Association (ISMA).

Primary Research

Extensive primary research has been conducted after understanding and analyzing the photovoltaics market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 30% of the primary interviews were conducted with the demand side and 70% with the supply side. Primary data was mainly collected through telephonic interviews, which comprised 80% of the overall primary interviews; questionnaires and emails were also used to collect the data.

Note: Other designations include sales and marketing executives and researchers, as well as members of various photovoltaic technology organizations.

Sales, business development, and product managers are covered under the “managers” category.

Three tiers of companies are defined based on their total revenue as of 2024: tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, we have implemented top-down and bottom-up approaches to estimate and validate the size of the photovoltaics market and various other dependent submarkets. Key players in the photovoltaics market have been identified through secondary research, and their market shares in respective regions have been determined through primary and secondary research. This entire research methodology includes the study of annual and financial reports of top companies, as well as interviews with experts (CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed input and analysis from MarketsandMarkets and presented in this report. The figures below show the overall market size estimation process employed for this study.

Bottom-Up Approach

- Identifying key participants in the photovoltaics market that influence the entire market, along with the related component players

- Analyzing major manufacturers of PV components such as modules, inverters, and BOS, studying their portfolios, and understanding their different products

- Analyzing trends pertaining to the use of PV devices for different kinds of applications

- Tracking the ongoing and upcoming developments in the market, such as investments, R&D activities, product launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying multiple discussions with key opinion leaders to understand different types of PV components and applications and recent trends in the market, analyzing the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing revenues of companies generated and then combining the same to get the market estimate

- Segmenting the overall market into various other market segments

- Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

Top-Down Approach

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the photovoltaics market. Further splitting into component, material, cell type, installation type, and application, and listing key developments in key market areas

- Identifying all major players in the photovoltaic devices market by component and material, and their penetration in various applications through secondary research and verifying with a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications for which photovoltaic systems and components are served by all identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with the industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Photovoltaics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using the top-down and bottom-up approaches.

Market Definition

According to the Solar Energy Industries Association (SEIA), photovoltaic (PV) devices generate electricity directly from sunlight via an electronic process that occurs naturally in certain types of materials called semiconductors. Electrons in these materials are freed by solar energy and can be induced to travel through an electrical circuit, powering electrical devices or sending electricity to the grid.

Key Stakeholders

- PV cell manufacturers

- PV module manufacturers

- Raw materials and manufacturing equipment suppliers

- PV market technical consultants

- Technology standards organizations, forums, alliances, and associations

- Governments, financial institutions, and investment communities

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startup companies

- Distributors

Report Objectives

- To describe, segment, and forecast the photovoltaics market, by component, type, material type, cell type, installation type, and application, in terms of value

- To describe and forecast the photovoltaics market, by component, in terms of volume

- To describe the power capacity ranges and photovoltaic (PV) concentration systems of photovoltaics (PV)

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and RoW, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the photovoltaics market

- To provide a detailed overview of the supply chain and ecosystem pertaining to the photovoltaics market, along with the average selling price of PV components

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter’s five forces analysis, 2025 US tariff, AI/Gen AI impact, and regulations pertaining to the market

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets about individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches and developments, expansions, partnerships, collaborations, contracts, and acquisitions in the photovoltaics market

- To strategically profile the key players in the PV market and comprehensively analyze their market ranking and core competencies.

- To evaluate the impact of macroeconomic factors on the regional market

Available customizations:

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

What are the major driving factors and opportunities for players in photovoltaics market?

The major factors driving the photovoltaics market include the rising solar installations due to government-led incentives and schemes, the growing adoption of PV systems in residential applications, and the decreasing cost of energy storage devices. Key opportunities lie in the increasing investment in renewable energy and ongoing technological developments such as Perovskite solar cell manufacturing.

Which region is expected to hold the largest share of the photovoltaics market in 2025?

Asia Pacific is projected to capture the largest market share in 2025 due to favorable government policies.

Who are the leading players in the global photovoltaics market?

Leading players operating in the global photovoltaics market include Jinko Solar (China), JA SOLAR Technology Co., Ltd. (China), Trinasolar (China), LONGi (China), and Tongwei Co.Ltd (China).

Which advanced technologies are expected to drive the photovoltaics market?

Quantum dots, dye synthesized, and perovskite are expected to drive the market.

What will be the size of the global photovoltaics market in 2025 and 2035?

The global photovoltaics market is projected to grow from USD 613.57 billion in 2025 to USD 968.32 billion by 2030, at a CAGR of 9.6% during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Photovoltaics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Photovoltaics Market

Mateusz

Apr, 2022

I would like to receive, if possible, detailed data on the current North American market in the field of energy banks and photovoltaics, as well as projected photovoltaic market forecasts for the coming years. Thank you in advance and best regards.

Jy

Feb, 2016

Interested in PV market(month/year) according to application (residential, industrial and utility scale) in the US for current and estimates in 2020 and 2030.

Basem

Feb, 2019

I am Master's Student, I would like to have market prices for solar cells as capital cost, replacement cost, O&M as well. I hope can find the report help me in my research. .

Lawrence

Aug, 2019

Please forward brochure. No purchase at this time, but wish to follow for possible future reference. .

SIYA

May, 2022

Hello, sir good day please help us to give input of the African solar PV market possibility. .

Mary

Sep, 2019

I work at the Federal Housing Finance Agency and would like to better understand PV systems market size..

gou

May, 2019

Interested in knowing the penetration of thin film PV application in South Africa and market share of the main players. .